Бінарні опціони в Україні 2026: рейтинг кращих брокерів

Бінарні опціони в Україні у 2026 році залишаються суперечливим, але популярним інструментом для швидкої торгівлі. Ця стаття розповідає, що таке бінарні опціони, як працюють брокери бінарних опціонів і на що дивитися перед тим, як поповнювати рахунок.

Тут зібрано рейтинг популярних платформ, базові пояснення “що таке бінарні опціони”, основні види контрактів і короткі поради для новачків. Це не обіцянка заробітку, а спроба чесно описати можливості й ризики.

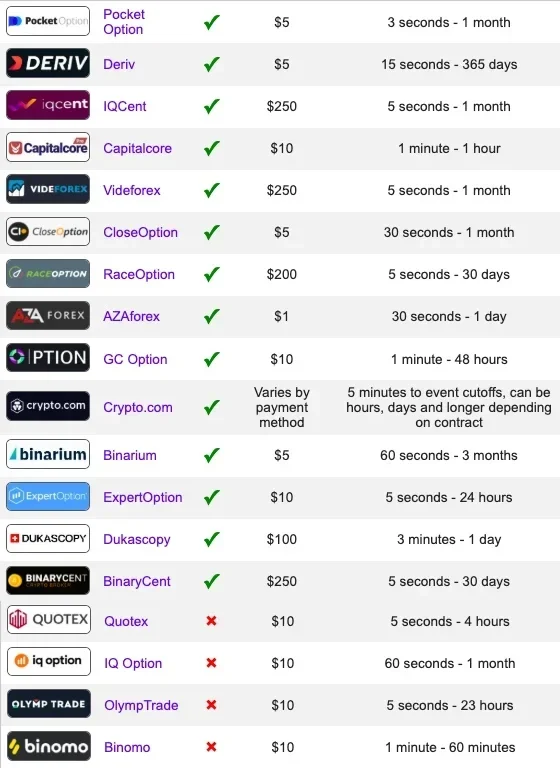

ТОП брокерів бінарних опціонів в Україні (2026)

Нижче – добірка популярних брокерів бінарних опціонів, з якими працюють трейдери з України. Це не фінансова рекомендація, а стартовий список для власного аналізу.

| Брокер | Мінімальний депозит | Демо-рахунок | Орієнтовні виплати | Особливості |

|---|---|---|---|---|

| Binarium | $5 | Є, близько $10 000 віртуальних коштів | до ~90% на популярних активах | Орієнтація на трейдерів з України та СНД, простий веб-термінал, навчальні матеріали. |

| Binolla | $10 | Є, близько $10 000 | до ~92% за успішними угодами | Понад 200 активів, низький поріг входу, ставки від $1, підтримка криптовалют. |

| Binomo | $10 | Є, близько $10 000 | приблизно 85–90% | Член FinaCom, кілька типів рахунків, регулярні турніри, локалізована підтримка. |

| Olymp Trade | $10 | Є, близько $10 000 | в середньому 80–90% | Ліцензія VFSC, член FinaCom, є режим Fixed Time Trades і доступ до Forex. |

| Pocket Option | $5 | Є, близько $10 000 | до ~90% і вище, залежно від активу | Понад 100 активів, соціальний трейдинг, турніри, швидке виведення. |

| Stockity | $10 | Є, близько $10 000 | високі фіксовані відсотки, точні значення залежать від активу | Проста реєстрація без обов’язкової верифікації на старті, кілька типів рахунків, турніри. |

У повній статті окремий підрозділ можна зробити для кожної платформи, з детальнішими умовами та реальними “бінарні опціони відгуки”, але на старті вистачить такого огляду.

Чому важливо не гнатися лише за відсотком виплат

- Високі відсотки по угодах не мають сенсу, якщо брокер затягує або блокує виведення.

- Краще мати трохи нижчу виплату, але стабільний вивід і більш-менш адекватну підтримку.

- Перед депозитом читай відгуки не тільки на сайті брокера, а на незалежних ресурсах.

Як обирали брокерів бінарних опціонів

Брокери в списку вище відібрані за набором базових критеріїв, які мають значення для трейдера з України. Ці критерії можна використати й для оцінки інших платформ, що не потрапили в таблицю.

| Критерій | Що дивитися | Чому це важливо |

|---|---|---|

| Комісії | Спреди, приховані платежі, умови виведення, плата за неактивність. | Чим більше неторгових комісій, тим дорожче торгувати, особливо при невеликому депозиті. |

| Торгові інструменти | Кількість активів, типи бінарних опціонів, наявність крипти, індексів, акцій. | Більше інструментів = більше сценаріїв для торгівлі, а не тільки одна валютна пара. |

| Системи виведення | Карти, електронні гаманці, криптовалюти, локальні методи. | Чим ширший вибір, тим простіше виводити кошти так, як зручно саме тобі. |

| Швидкість виведення | Середній час обробки заявок, відгуки користувачів, залежність від типу рахунку. | Якщо гроші йдуть днями чи тижнями, це вже червоний прапорець. |

| Термінал і платформа | Зручність інтерфейсу, доступ з мобільних, наявність веб-версії та застосунку. | Незручний термінал веде до помилок, особливо при швидких угодах. |

| Репутація | Рік заснування, регуляція, реальні відгуки, участь у FinaCom чи подібних організаціях. | Сіра репутація + офшор без будь-якого нагляду = високий нефінансовий ризик. |

- Не варто спиратись лише на рекламні рейтинги, де всі “топ” і “кращі”.

- Корисно звірятися одразу по кількох джерелах і шукати негатив, а не тільки позитив.

Що таке бінарні опціони

Бінарні опціони – це прості за формою контракти, де є лише два результати: фіксований прибуток або втрата ставки. Ти не купуєш сам актив, а просто ставиш на напрям руху ціни за обраний час.

Якщо говорити “по-людськи”, бінарний опціон – це ставка “ціна буде вище” або “ціна буде нижче” через певний проміжок часу. Якщо прогноз влучний, ти отримуєш заздалегідь відомий відсоток, якщо ні – втрачаєш суму угоди.

Простий приклад бінарного опціону

- Ти обираєш актив, наприклад золото або пару EUR/USD.

- Встановлюєш час експірації, скажімо 5 хвилин.

- Робиш прогноз: ціна буде вище поточного рівня через 5 хвилин.

- Обираєш суму, наприклад $100, і відкриваєш бінарний опціон.

Припустимо, брокер пропонує виплату 85% за правильний прогноз. Якщо через 5 хвилин ціна реально вища, ти отримуєш назад $100 + $85 прибутку.

Якщо ціна виявиться нижчою, весь контракт програє, і ти втрачаєш $100. Ось чому бінарні опціони це “все або нічого” – тут немає часткового виходу, як у класичному Forex.

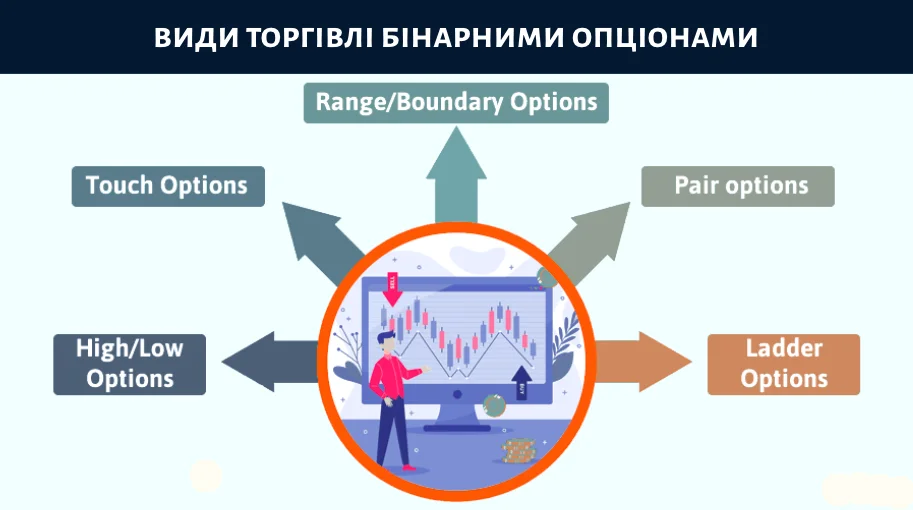

Види бінарних опціонів

У різних брокерів набір типів може відрізнятися, але базові види бінарних опціонів схожі. Краще розуміти ці формати перед торгівлею, а не натискати кнопки навмання.

- High/Low (Call/Put) – класичний тип, де потрібно спрогнозувати, чи буде ціна вище або нижче поточного рівня на момент експірації.

- One Touch – опціон, де ціна має хоча б раз торкнутися заданого рівня до закінчення часу.

- Turbo / Short-Term – короткі угоди від 30 секунд до кількох хвилин, для любителів швидкої торгівлі.

- Long-Term – опціони з тривалим терміном життя, від кількох днів до місяців.

- Boundary (Range) – ставка на те, чи залишиться ціна в межах заданого діапазону або вийде за нього.

- Ladder – “драбина” з кількох рівнів, де кожен рівень дає свій потенційний відсоток виплати.

- Crypto-опціони – те саме, але базовими активами виступають криптовалюти.

Новачкам зазвичай радять починати з класичних High/Low, бо вони найпростіші логічно. Складні формати з високими виплатами виглядають привабливо, але часто дають більший ризик помилки.

Бінарні опціони чи Forex? У чому різниця?

Багато новачків не розуміють, чим бінарні опціони відрізняються від класичної торгівлі на Forex.

Обидва дозволяють заробляти на зміні цін, але механіка зовсім різна.

| Параметр | Бінарні опціони | Forex |

|---|---|---|

| Результат угоди | Фіксований прибуток або збиток. Наперед знаєш, скільки отримаєш (+80-90%) або втратиш (ставку). | Нефіксований. Залежить від того, наскільки ціна зрушила. Можна заробити набагато більше або втратити все через плече. |

| Час експірації | Є заданий термін. Угода закривається автоматично через обраний час. | Немає обмеження. Сам вирішуєш, коли закривати позицію. |

| Управління угодою | Після відкриття не можеш нічого змінити. Деякі брокери дають достроковий продаж, але це рідкість. | Повна гнучкість: стоп-лосс, тейк-профіт, додавання до позиції, часткове закриття. |

| Ліцензування | Більшість брокерів офшорні. У багатьох країнах бінарні опціони заборонені або не регулюються. | Forex-брокери частіше мають ліцензії серйозних регуляторів (FCA, CySEC, НБУ тощо). |

| Прибутковість і комісії | Прибуток обмежений відсотком виплати. Комісій за угоди немає, але брокер заробляє на статистиці виплат. | Прибуток необмежений, але є спред і комісії за оборот. Також свопи за перенесення позицій. |

Коли обирати бінарні опціони

- Хочеш заздалегідь знати максимальний ризик і потенційний прибуток.

- Подобається швидка торгівля з чітким таймфреймом.

- Не хочеш заморочуватись зі стоп-лоссами і складним мані-менеджментом.

Коли обирати Forex

- Потрібна гнучкість у керуванні позицією.

- Хочеш використовувати плече для збільшення прибутку (але й ризик зростає).

- Важлива наявність ліцензії та регулювання з боку держави.

Обидва варіанти ризиковані, але бінарні опціони простіші технічно. На Forex більше контролю, але й складнощів теж більше.

Поради для новачків у торгівлі бінарними опціонами

Якщо вирішив спробувати бінарні опціони, не кидайся одразу з реальними грошима.

Ось кілька базових порад, які допоможуть не злити депозит у перші години.

Почни з демо-рахунку

Усі нормальні брокери бінарних опціонів дають безкоштовний демо-рахунок із віртуальними грошима.

Це не гра – це тренування без ризику втрати реальних коштів.

- Відпрацюй базові стратегії на демо.

- Познайомся з інтерфейсом платформи.

- Подивись, як поводяться різні активи в різний час доби.

Не переходь на реальний рахунок, поки не отримаєш стабільний результат на демо протягом хоча б тижня-двох.

Вивчай стратегії для бінарних опціонів

Торгівля навмання – це найшвидший спосіб злити гроші.

Є купа безкоштовних стратегій для бінарних опціонів: торгівля за трендом, від рівнів підтримки/опору, за індикаторами.

- Обери одну просту стратегію і дотримуйся її.

- Не стрибай від стратегії до стратегії після кількох програшів.

- Веди статистику своїх угод – записуй, що спрацювало, а що ні.

Навіть погана стратегія краща за відсутність стратегії взагалі.

Обачно з торговими сигналами

В інтернеті повно сервісів, що продають або роздають сигнали для бінарних опціонів.

Деякі реально допомагають, але більшість – шлак.

- Не довіряй сигналам сліпо. Вони можуть бути застарілими або неточними.

- Якщо хочеш використовувати платні сигнали, спочатку протестуй їх на демо.

- Краще навчитись аналізувати ринок самостійно, ніж залежати від чужих порад.

Управляй ризиками

Це найважливіше правило в торгівлі бінарними опціонами.

Встанов для себе ліміт: скільки відсотків від депозиту ризикуєш в одній угоді.

- Стандартна рекомендація – не більше 2-5% від депозиту на одну угоду.

- Не намагайся відігратися після серії програшів, збільшуючи ставки.

- Якщо за день втратив певний відсоток (наприклад, 10-15%), зупинись і повертайся завтра.

Емоційна торгівля вбиває депозит швидше за будь-яку погану стратегію.

Навчайся постійно

Ринок постійно змінюється, і те, що працювало минулого місяця, може не працювати зараз.

Дивись навчальні відео, читай статті, аналізуй свої помилки.

- Багато брокерів бінарних опціонів мають свої освітні розділи з вебінарами та гайдами.

- Вивчай технічний аналіз – це основа для прогнозування цін.

- Слідкуй за новинами, особливо якщо торгуєш на коротких таймфреймах.

Сигнали бінарних опціонів

Сигнали для бінарних опціонів – це рекомендації, коли і в який бік відкривати угоду.

Їх генерують люди або алгоритми на основі аналізу ринку.

Сигнали бувають безкоштовні (часто в телеграм-каналах або на форумах) і платні (підписки на сервіси).

Безкоштовні часто запізнюються або не мають достатньо точності, але для новачка можуть бути корисні як підказка.

Типи сигналів для бінарних опціонів

- Технічні сигнали – базуються на графіках і індикаторах: перетини ковзних середніх, RSI, MACD, свічкові паттерни.

- Фундаментальні сигнали – прив’язані до новин і подій: публікація звітів компаній, рішення центробанків, макроекономічна статистика.

- Новинні сигнали – реакція на важливі події в реальному часі, наприклад, геополітичні новини чи зміна ставок ФРС.

- Паттерн-сигнали – виявлення графічних фігур на графіку: “голова і плечі”, “трикутник”, “прапорець”.

- Індикаторні сигнали – автоматичні сигнали на основі показників типу Bollinger Bands, Stochastic, ADX.

Як використовувати сигнали

- Не відкривай угоду тільки тому, що десь побачив сигнал. Перевір його самостійно.

- Спочатку протестуй сигнали на демо-рахунку – подивись, який відсоток спрацьовує.

- Якщо платиш за сигнали, вимагай статистику та можливість тестового періоду.

Сигнали можуть бути корисним доповненням до власного аналізу, але не заміною йому.

Основні критерії вибору брокерів бінарних опціонів

Вибір брокера – це не менш важливо, ніж вибір стратегії.

Навіть якщо ти торгуєш ідеально, поганий брокер може не вивести гроші або заморозити рахунок.

На що дивитися при виборі брокера

| Критерій | Що перевіряти |

|---|---|

| Комісії | Чи є комісії за поповнення, виведення, неактивність рахунку. Чим менше – тим краще. |

| Торгові інструменти | Скільки активів доступно: валютні пари, акції, індекси, криптовалюти. Більше = більше можливостей. |

| Системи виведення | Чи підтримує брокер картки, електронні гаманці, криптовалюту. Чи є зручний для тебе метод. |

| Швидкість виведення | Скільки часу йде на обробку заявки. Якщо більше тижня – це погано. |

| Платформа | Зручність інтерфейсу, наявність мобільного додатку, стабільність роботи терміналу. |

| Репутація | Відгуки на незалежних форумах, рік заснування, наявність регуляції або членство в організаціях типу FinaCom. |

Червоні прапорці

- Брокер обіцяє гарантований прибуток або безпрограшні стратегії.

- Нереально високі бонуси з складними умовами відіграшу.

- Відсутність контактів або підтримки, яка не відповідає.

- Купа негативних відгуків про проблеми з виведенням коштів.

- Брокер не дає демо-рахунок або ховає умови торгівлі.

Краще витратити кілька годин на перевірку брокера, ніж потім тижнями намагатися повернути свої гроші.

Оцінка ризиків торгівлі бінарними опціонами – думка експерта

Бінарні опціони – це ризикований інструмент. Це факт, а не спроба налякати.

Статистика показує, що більшість новачків втрачає гроші в перші місяці торгівлі.

Основний ризик простий: не вгадав напрям руху ціни – втратив ставку.

На відміну від Forex, тут не можна встановити стоп-лосс на рівні мінімального збитку. Або виграв, або програв повністю.

Основні ризики бінарних опціонів

- Ринковий ризик – ціни можуть рухатися непередбачувано, особливо під час новин або низької ліквідності.

- Психологічний ризик – після кількох програшів виникає бажання відігратися, що часто призводить до ще більших втрат.

- Ризик брокера – офшорні брокери можуть заблокувати рахунок, затягнути виведення або зникнути разом із грошима клієнтів.

- Технічний ризик – проблеми з платформою, зависання під час важливих угод, затримка котирувань.

Як знизити ризики

- Не ризикуй більше 2-5% депозиту на одну угоду.

- Торгуй тільки за стратегією, а не на емоціях.

- Веди журнал угод – записуй усі входи, виходи та причини рішень.

- Не використовуй гроші, які не можеш дозволити собі втратити.

- Обирай брокерів із хоча б мінімальною репутацією та регуляцією.

Порівняння ризиків: бінарні опціони vs Forex

На Forex ти можеш встановити стоп-лосс і обмежити збиток. На бінарних опціонах такої опції немає.

Але з іншого боку, на Forex плече може призвести до втрати більше, ніж початковий депозит.

Обидва інструменти ризиковані, але бінарні опціони ризикованіші через формат “все або нічого”.

Якщо у тебе 10 угод і 5 з них програшні, ти вже в мінусі, навіть якщо інші 5 виграшні.

Як заробити на бінарних опціонах?

Реально заробити на бінарних опціонах можна, але це не легкі гроші.

Потрібні знання, дисципліна і час на навчання.

Навчання за спеціалізованими матеріалами

Перш ніж відкривати реальні угоди, витрать хоча б кілька тижнів на вивчення основ.

Є безкоштовні курси, відео на YouTube, статті про технічний аналіз.

- Вивчи базові індикатори: RSI, MACD, ковзні середні.

- Познайомся з свічковим аналізом – це основа прогнозування цін.

- Дізнайся, як новини впливають на ціни активів.

Деякі брокери бінарних опціонів пропонують свої навчальні матеріали. Використовуй їх, але не обмежуйся тільки ними.

Тренування на демо-рахунку

Теорія без практики не працює. Відкрий демо-рахунок і торгуй віртуальними грошима.

Мета – не просто “пограти”, а відпрацювати конкретну стратегію.

- Веди статистику демо-угод так само серйозно, як і реальних.

- Не переходь на реальний рахунок, поки не досягнеш стабільного плюса на демо.

- Тестуй різні активи і таймфрейми – знайди те, що тобі зручніше.

Практика в реальних умовах

Коли на демо все виходить стабільно, можна спробувати реальний рахунок.

Але починай з мінімальних сум – не вливай одразу великі гроші.

- Перші кілька тижнів торгуй мінімальними ставками, навіть якщо це здається нудно.

- Психологія реальної торгівлі відрізняється від демо – емоції сильніші.

- Якщо бачиш, що стратегія не працює в реалі, повертайся на демо і коригуй підхід.

Формула розрахунку заробітку на бінарних опціонах

Скільки можна заробити – залежить від кількох факторів:

1. Відсоток прибутку

Брокери пропонують виплати від 70% до 92% за успішну угоду.

Якщо купуєш бінарний опціон на $10 з виплатою 85%, при виграші отримаєш $10 + $8.5 = $18.5.

2. Вартість контракту

Чим більша ставка, тим більший потенційний прибуток. Але й ризик зростає пропорційно.

Не ставай більше 2-5% від депозиту на одну угоду.

3. Кількість угод

Можна робити кілька угод на день або кілька на тиждень. Більше угод – більше потенційного прибутку, але й більше помилок.

Краще 3-5 якісних угод, ніж 20 хаотичних.

4. Розмір депозиту

Якщо депозит $50, розумно ставити по $1-2 на угоду. Якщо $500 – можна підняти до $10-25.

Малий депозит обмежує маневр, але й ризик втрати менший.

5. Співвідношення виграшів і програшів

Це найважливіше. Навіть з виплатою 85%, якщо виграєш тільки 50% угод, ти в мінусі.

Щоб бути в плюсі з виплатою 85%, потрібно виграти мінімум 55-60% угод.

Приклад: депозит $200, ставка $10 на угоду (5% від депозиту), виплата 85%.

Якщо зробиш 10 угод і виграєш 6 з них:

- 6 виграшів × $8.5 прибутку = $51

- 4 програші × $10 втрати = $40

- Чистий прибуток: $51 – $40 = $11

За 10 угод заробив $11, або 5.5% від депозиту. Якщо робиш це щодня, місячний прибуток може бути значним.

Але це ідеальний сценарій – на практиці емоції, помилки та невдачі зменшать результат.

Регулювання бінарних опціонів в Україні

Станом на 2026 рік в Україні немає спеціального закону, який би регулював бінарні опціони.

Це не означає, що вони заборонені – просто немає конкретних правил.

НКЦПФР (Нацкомісія з цінних паперів) загалом наглядає за фінансовими ринками, але бінарні опціони не входять у сферу її прямого контролю.

Тому більшість брокерів бінарних опціонів, що працюють з українцями, зареєстровані за кордоном.

Що це означає для трейдера

- Ти можеш вільно торгувати бінарними опціонами через міжнародні платформи.

- Але якщо виникне спір із брокером, українські регулятори не зможуть допомогти.

- Захист твоїх коштів залежить від того, наскільки брокер надійний і чи є в нього якась регуляція в інших країнах.

Захист інвесторів на ринку бінарних опціонів

Оскільки державного захисту немає, треба самому дбати про безпеку:

Перевірка брокера

- Шукай бінарні опціони відгуки на незалежних форумах, а не тільки на сайті брокера.

- Перевір, чи є у брокера ліцензія хоча б якогось регулятора (VFSC, CySEC, FinaCom).

- Подивись, скільки років брокер на ринку – новачки частіше зникають.

Управління ризиками

- Не клади на рахунок більше, ніж готовий втратити.

- Регулярно виводь прибуток, а не залишай все на рахунку.

- Якщо брокер починає гальмувати з виведенням – це сигнал негайно припинити торгівлю там.

Освіта та обізнаність

- Чим більше ти знаєш про те, що таке бінарні опціони, тим менше шансів потрапити на шахраїв.

- Слідкуй за новинами галузі – іноді з’являються попередження про конкретні платформи.

Міжнародна практика

У більшості розвинених країн бінарні опціони або заборонені, або жорстко обмежені:

- Європейський Союз – заборонені для роздрібних трейдерів з 2018 року.

- США – дозволені лише на регульованих біржах (NADEX, CBOE).

- Великобританія – FCA заборонила продаж бінарних опціонів населенню.

- Австралія, Канада – також є обмеження або заборони.

Ці країни вважають бінарні опціони занадто ризикованими для звичайних людей через високу ймовірність втрат.

В Україні поки таких обмежень немає, але це не означає, що інструмент безпечний.

Альтернативи бінарним опціонам в Україні

Якщо бінарні опціони здаються надто ризикованими або ти не впевнений у брокері, є інші варіанти для інвестування та торгівлі.

1. Форекс-торгівля

Класична торгівля валютними парами через регульованих Forex-брокерів.

На відміну від бінарних опціонів, тут ти маєш більше контролю над угодою: стоп-лосси, тейк-профіти, можливість закрити позицію в будь-який момент.

- Більше регульованих брокерів з ліцензіями серйозних органів.

- Можливість використовувати плече для збільшення прибутку (але й ризик зростає).

- Прибуток не обмежений відсотком – можна заробити набагато більше.

Мінус: складніше для новачків, потрібно розбиратися в мані-менеджменті та управлінні позиціями.

2. Фондовий ринок України

Українська біржа (UX) дозволяє купувати акції українських компаній та облігації.

Це регульований ринок під наглядом НКЦПФР.

- Реальне володіння активами – ти купуєш частку бізнесу, а не просто робиш ставку.

- Можливість отримувати дивіденди від прибуткових компаній.

- Нижчий ризик порівняно з бінарними опціонами, якщо інвестуєш на довгий термін.

Мінус: менша волатильність, тому швидких великих прибутків не буде. Це радше інвестиції, а не спекуляції.

3. Торгівля криптовалютою

Біткоїн, Ефіріум та інші криптовалюти – популярний вибір серед українських трейдерів.

Ринок дуже волатильний, що дає можлив